What’s happening in re-commerce (and what have we learnt from Knihobot)

Michala Gregorová

It’s been a year since we recorded our podcast episode about re-commerce. It’s high time we took another look at what’s been going on (the blog version of this Twitter thread follows).

Why the hype, you ask? After all, second-hand has been around for ages, right?

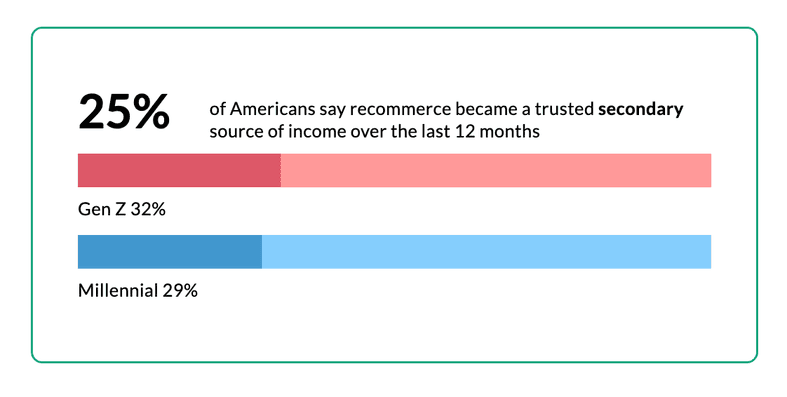

Yes and no. Buying second-hand is nothing new. What is new is the growing habit of selling used items. OfferUp Re-commerce Report: “32% of American Gen Zers have resale as their secondary income.”

When buying a new item, younger generations in particular consider and calculate how much they will be able to resell the item for in the future. So, what older generations already do to buy a used car, we may soon do to buy a Patagonia jacket or a designer handbag.

Why is re-commerce on the rise?

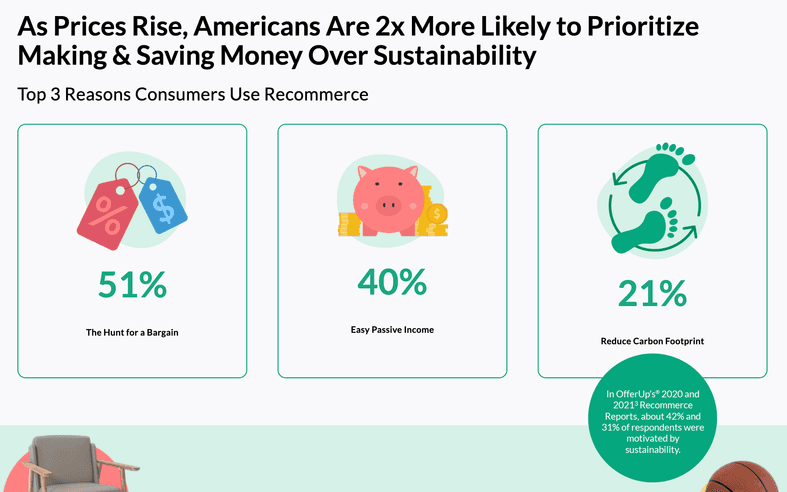

- Record inflation forces us to think where to save or earn money.

- We are becoming increasingly remorseful about our behaviour towards nature.

- Brands are starting to see an opportunity to improve their margins and enhance their image through repeat turnover.

What are some other factors helping re-commerce?

- There are more and more startups that make reselling easier. AI for item tagging or pricing, Resale-as-a-Service, authentication tools… Second-hand has always been around, yet the ecosystem lacked the key components, and that is currently changing.

- Many goods are sold online, which means they are already photographed, contain a description as well as an existing digital price trail.

- The logistics have become highly densified. An example being the Czech delivery company Zásilkovna for p2p.

- Many more products are global, so they find future owners more easily.

To which extent could this grow?

What can be seen in the crystal ball depends on who’s looking into it.

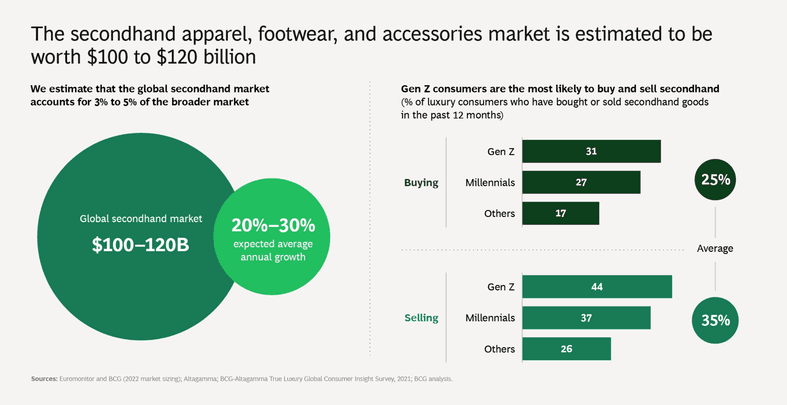

- In fashion, it could represent up to a third of our wardrobe and 20% of the fashion brands' turnover.

- OfferUp: "The re-commerce market is projected to reach $289B by 2027 and grow 5x faster than the overall retail market."

- BCG:

From innovation to expectation

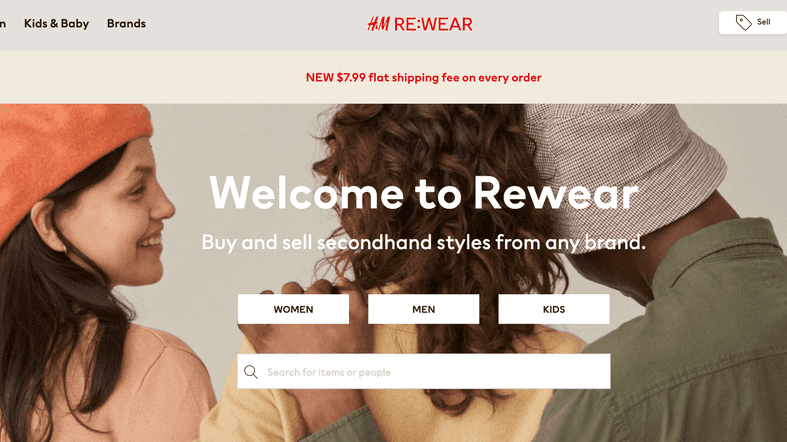

Most of this happens in fashion. Every week, big brands launch pre-loved sections on their websites. It’s safe to say that most of the time it's just for PR rather than being a real business model innovation. But more on that topic next time.

What is holding re-commerce back?

- The simple fact that things often don’t manage to outlive their first owner

- Complex logistics (transitioning from p2p, handling each item individually)

- The persisting stigma of goods being second-hand

Source: McKinsey State of the Fashion 2021 (from page 63)

And that brings us to the five lessons we learned from our 2 years with Knihobot.

1. The bottleneck is on the supply side

Patagonia would sell 10 times more jackets if they knew how to obtain them from their customers. The same observation happens with Knihobot. Selling 3x more good books would be a piece of cake. The difficult part is acquiring the books. And that ability is what determines success.

2. Money is not the main motivation (at first)

The first motive is to “get your house in order”. But even so, you shouldn’t leave your customers disappointed by the amount of commission, otherwise they won't come back a second time.

3. Comfort is key

Most people have never sold their books and even the slightest barrier could discourage them to do so. The courier comes to pick up the books in person for free, still many customers often prefer to bring the books themselves to a Knihobot branch. And even having to take a single photo of the books puts many of them off.

4. Logistics can be a tough nut to crack

How to make the buyout as convenient as possible? The courier pickup is free, but the books need to first be packed into a box, which is a hassle, even for the delivery company Zásilkovna. Running our own branches can be expensive, so what about Knihobot boxes? Most of them can’t do take-backs, but even if they could, how could one collect books from such a large number of places? And what about abroad?

5. Complexity

Knihobot is not “just” an e-shop, the service needs to make sure that both parties, customers and suppliers, come out satisfied. This requires operational excellence (done), but how about pricing? And how to source books abroad?

Stay tuned (or come help).

Resources for further study:

Share

Of further interest

What happened: Fall/Winter 2025

The second half of the year, like the whole year (and the two previous ones as well), was marked by AI. This year will be no different. There will be a lot of AI in this summary too. But we’ll also add a bit of crypto and psychedelics.

PangeAI emerges from stealth to democratize access to geospatial data

(press release) A startup founded by Johanna von der Leyen and Marek Miltner at Stanford is changing the way companies and public institutions work with geospatial data. Instead of needing to hire a team of GIS experts, PangeAI agents allow making complex analyses and decisions involving physical infrastructure as easy as typing a prompt. The goal is to make the physical world as searchable and understandable as the digital one.

Every company wants to become more efficient thanks to AI, and almost none succeed. Miton is investing €400k into a startup that wants to fix this.

(press release) Even though companies know very well that AI can significantly increase their efficiency, most never get further than paying for ChatGPT accounts for their employees. It’s not motivation they lack - most fail in the implementation phase. The problem lies in the approach companies take: they treat AI as if it were traditional software. And this is exactly where Bandits comes in, a new project by Jiří Štěpánek, Kryštof Mitka and Miton.